When we think of getting a loan, the first thing that comes to mind is a bank. However, there are several issues that a person must deal with when applying for a bank loan. These issues include wasting time, filling out unnecessary paperwork, and, finally, high demand for interest rates.

Aside from banks, we can also find a reputable lender in the market, but this is not an easy task. We must exercise extreme caution when selecting a lender in order to avoid being taken advantage of by unscrupulous lenders. As a result, there is a need for a platform that connects users with trustworthy lenders without charging a dime.

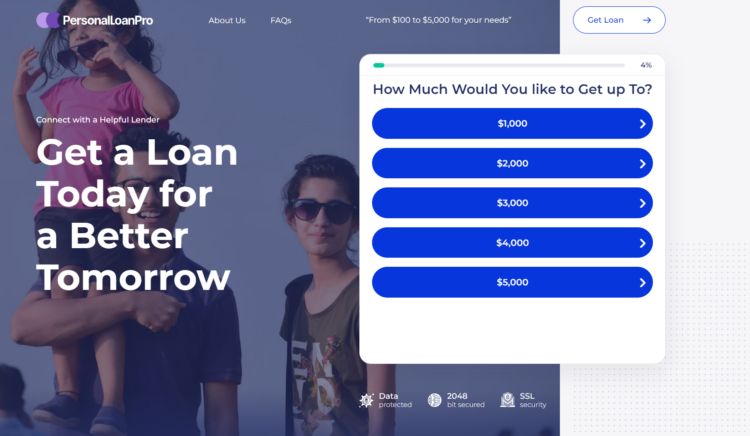

Personal Loan Pro is without a doubt the most recommended and incredible working loan broker that provides complete protection to its customers. You will be given a list of lenders from which to choose based on your requirements and needs. So, let’s learn more about this amazing platform and how it works.

Table of Contents

Who is a Personal Loan Pro?

Personal Loan Pro is developing a strategy to provide easy access to cash. The platform assists its customers in finding the best lender. They assist reputable lenders all over the internet. The loan process is intended to improve borrowers’ access to cash in a timely and easy manner.

Personal Loan Pro connects you with a large network of lenders to assist you in locating a personal loan offer. The platform ensures that borrowers receive high-quality loan proposals. The platform aims to make every client experience so pleasant that they will recommend it to their friends. Borrowers can use this platform for free. When a borrower obtains a loan from them, they receive a commission from the lender. Visit the website of Personal Loan Pro to get personal loans for bad credit.

The Pros & Cons of Personal Loan Pro

Pros

There’s a lot to appreciate about the Personal Loan Pro website, but here are some of the most significant ones of this platform:

You can easily compare offers from various lenders: This is the main feature of Personal Loan Pro and the reason you should use it. When you submit your information, Personal Loan Pro matches you to various loan providers who may be able to provide you with funding. Instead of visiting the websites of lots of providers to find the best rates and terms, you can get quotes and evaluate terms from multiple lenders all in one place.

Personal Loan Pro provides the list of lenders in its network: You can see the various partners with whom the website collaborates by visiting its Network Partners page. The website also states that it does not provide quotes from every lender available, so it is clear about its limitations. However, Personal Loan Pro collaborates with a number of companies.

When you apply, your credit will not be affected: Some lenders begin with a hard credit check, which means an inquiry will appear on your credit report for two years. A high number of hard credit checks can harm your credit score. You do not need to worry about this happening when you send your initial information to Personal Loan Pro because it starts with a soft credit check — though a hard credit check will still affect your credit if you decide to proceed with the loan.

You have a lot of flexibility in terms of how much you can borrow: Personal Loan Pro allows you to borrow as little as $100 and as much as $5,000. It’s not uncommon for lenders to set higher minimum or lower maximum loan limits, which implies you might not be able to borrow the full amount you require. In that regard, Personal Loan Pro provides far more flexibility than a typical service, so why not give it a try?

Cons

Source: moneycrashers.com

However, there are some areas where Personal Loan Pro could improve. The cons are as follows:

There is no guarantee that you will be approved for a loan at the offered interest rate: When you fill out an initial application with Personal Loan Pro, you will be able to view loan offers. However, if you want to proceed with a specific offer, you must still go through the entire application process with that lender. Depending on the lender’s procedure and your financial situation, you may be denied the loan or offered on various terms than you were initially offered.

Personal Loan Pro’s website contains only a limited amount of information: Personal Loan Pro does not explain how it determines which lender quotes to show or how many loan options it may offer you. It also gives only a limited picture of who is likely to be eligible for financing. It, for example, does not specify the minimum credit score needed to qualify for a loan from one of its partner lenders.

How Does Personal Loan Pro Work?

Personal Loan Pro matches you with loans that are a good fit for you. You’ll need to fill out a quick and free online application, which will not affect your credit score unless you choose one of the borrowing options. Your loan request is routed through the company’s network of lenders, and any offers that you are eligible for are returned to you. Its borrowing terms are determined by factors such as your credit score, loan amount, and repayment timeline.

What Can You Use Personal Loan Pro for?

This platform allows people to apply for various types of personal loans. They do not provide other types of loans, such as mortgages, commercial loans, and business loans. This platform accepts the following types of personal loans:

Source: dailybayonet.com

- Debt Consolidation

- Medical Personal Loan

- Home Improvement Loan

- Credit Card Consolidation Loan

- Vehicle Purchase

- Major Purchase

- Start a Business

- Education Loan

- Vacation Loan

- Wedding Expenses

Conclusion

Because you can submit a single application and have several lenders provide you with borrowing options, websites like Personal Loan Pro have made it much easier to quickly go for and compare the best personal loans. This can be very helpful in achieving your personal financial goals. Personal Loan Pro is a good site to use if you want to streamline the loan application process, thanks to the complete disclosure of its partner lenders and the flexibility in the amount you can borrow.

Source: forbes.com